The Sovereign Yidindji Government launched a digital version of their Sovereign Yidindji Dollar (SYD) on January 26, 2022, and the first successful transaction was confirmed on February 1. The new payment system is connected to the MetaMUI self-sovereign identity system that is already in use throughout Yidindji. The Sovereign Yidindji Government and MetaMUI are calling the SYD a central bank digital currency (CBDC) and the purpose of this post is to ascertain the “CBDCness” of the SYD.

Yidindji is an Australian pre-colonial indigenous nation that asserted its independence and continuing validity of Yidindji laws and customs in 2014, in accord with Resolution 1514 adopted by the United Nations General Assembly in 1960. However, until a treaty is signed between the governments of the Commonwealth of Australia and the Sovereign Yidindji Government, regarding land rights, Yidindji will not be represented by the United Nations or international law.

Is the SYD a central bank digital currency?

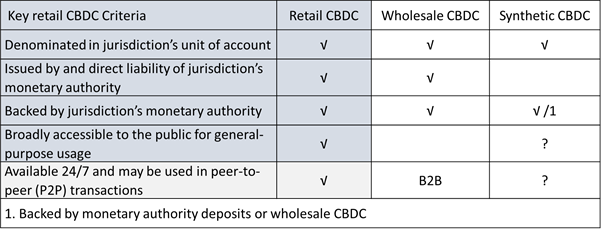

According to the Bank for International Settlements (BIS) a CBDC is a digital payment instrument, denominated in the jurisdiction’s unit of account, that is issued by and a direct liability of the jurisdiction’s central bank or monetary authority. The SYD is a obviously a digital payment instrument, and the rest of this note argues that it seems to meet the other BIS CBDC criteria too.

Does the Yidindji Nation have a central bank?

The Yidindji Reserve Bank Act 2016 established the Yidindji Reserve Bank (YRB) as the central bank of the Yidindji Nation to issue SYD. The SYD was pegged to the Australian Dollar (AUD) and backed by gold and silver.[1] The Yidindji Department of the Treasury guarantees the ability to exchange from SYD to AUD. Appropriate amounts of AUD are held by the YRB to for these exchanges. (Before the introduction of the digital currency, SYD transactions were settled in commercial bank money on a manual ledger.)

However, according to the Act, the YRB wasn’t responsible for some of the key functions associated with a central bank. The YRB had no payment system role, and it was prohibited from issuing bearer money, both foundational central bank roles. But the Act was revised in 2022 to give the YRB typical central bank responsibilities, including issuing currency, regulating/supervising deposit-taking institutions, and overseeing and promoting an efficient, sound, and safe payment system. So, Yidindji has a central bank.

Is the SYD denominated in the Yidindji’s unit of account?

To be a unit of account, a currency must be usable as a medium of exchange across a variety of transactions between several people and as such represent a form of co-ordination across society. The Yidindji Currency Acts of 2014 and 2022, Yidindji citizens must settle their obligations in SYD, and Australian citizens must settle their obligations in AUD.[2] But the two currencies are convertible one-to-one, it would seem that, if the digital SYD is convertible one-to-one into SYD and AUD, which are both units of account in Yidindji, then there’s no reason to dispute its status as a unit of account.

Conclusion

When Yidindji’s central bank is fully operational and carrying out typical central bank operations and responsibilities, the digital SYD will indeed be a CBDC, as it will meet all other CBDC defining criteria; like being issued and backed by, and a direct liability of, Yidindji’s central bank, and being denominated in Yidindji’s unit of account.

[1] Gold and silver bars are kept in two undisclosed locations. These bars are from internationally recognized mints and meets current standards of fineness, majority are from Perth Mint with much smaller amounts from other mints. All bars are in accord with the specifications of the LBMA Good Delivery Rules though not listed on the LBMA list. Once again it is this lack of formal agreement to be seen legally in the UN sphere of jurisdiction. The gold is rebalanced on a monthly basis, whilst audits of the metals take place at three monthly intervals.

[2] Upon the completion of a treaty with the Commonwealth of Australia, the SYD will be the only mechanism for Yidindji residents to discharge their monetary obligations.